Most Recent News

Popular News

Addressing the very common boomer phrase of "When I was your age".

The generations:

Left here without comment:

This depressing chart shows the jaw-dropping wealth gap between millennials and boomers

When baby boomers (born between 1946 and 1964) hit a median age of 35 in 1990, they collectively owned 21% of the nation’s wealth.

The millennial generation will hit that 35 median age in four years and they are nowhere near owning that percentage.

As a whole, boomers have fared better financially than Gen Xers (born between 1965 and 1980) and millennials (born between 1981 and 1996) throughout every stage of their lives. Boomers currently boast more than half (57%) of the nation’s wealth, while Gen X owns just 16%, and millennials 3%.

Adults under 40 have been accumulating less and less wealth over the past 30 years, plummeting from owning 13% of the wealth in 1989 to less than 7% today.

Indeed, at a median age of 35, Gen Xers owned just 9% of the nation’s wealth in 2008 — less than half what boomers had at that age. And millennials will have to triple their net worth in the next four years to catch up to Generation X at 35, and increase their wealth sevenfold to catch up to boomers at that age.

And:

Baby boomers’ wealth is 12 times greater compared to millennials. Here’s why

…

Rising housing costs are in part to blame for millennials’ difficulty accumulating wealth.

The median home value in the U.S. today is $227,700, according to Zillow. The number has skyrocketed since 1990, when the median home value was $79,100 (or $101,100, when adjusted for inflation) according to data from the U.S. Census Bureau.

Millennials have also been hit hard by student debt.

The Federal Reserve estimates that there is around $1.6 trillion in outstanding student debt in the U.S. and that, of the roughly 45 million America

And:

Millennials are deeper in debt than past two generations: study

New numbers have been crunched into “visualizations” illustrating just how broke the much-derided generation born between 1981 and 1996 is compared to baby boomers and Generation X.

Using Federal Reserve data, “cost information” website How Much found that adults ages 22 to 37 had a crushing average total debt of $84,600.

This number was far higher than the average debt Gen Xers and boomers had when they were 22 to 37 in 2001 and 1989, respectively. After adjusting for inflation, Gen X had a comparative $79,400 in average debt while boomers had just $59,300 — not shocking considering the higher cost of cars and education many young people have to contend with today.

And:

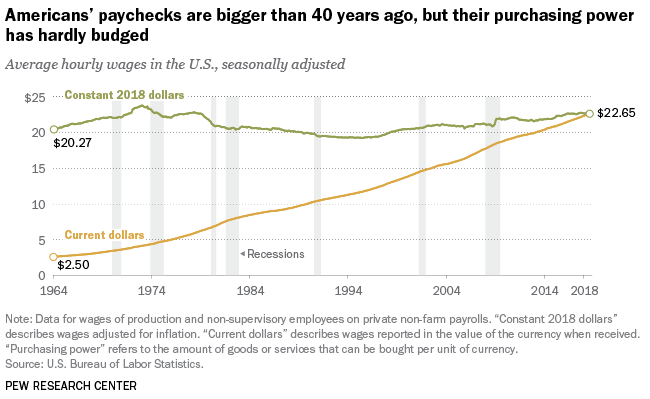

Overall, millennials earn 20% less than baby boomers did at the same stage of life, according to “The Emerging Millennial Wealth Gap,” a recent report from the nonprofit, nonpartisan think tank New America. Specifically, median earnings for those 18 to 34 are lower than they were in the 1980s, a disparity that was first noted in a 2017 report from the non-profit Young Invincibles. And the flow of today’s paychecks is less predictable due, in part, to the effects of the Great Recession and a rise in contract and freelance positions that may be less consistent in hours and pay.

That’s in spite of overall higher education levels. Nearly 40% of millennials 25 to 37 have at least a bachelor’s degree, compared to just a quarter of baby boomers and 30% of Gen X when they were the same age, Pew Research Center found.

…

“Income is stagnant, relative to the past, it’s been more volatile relative to the past — that combination leads people to have a lot less and be really suspect about making commitments to the future,” Cramer says.

And:

7 ways life is more expensive today for American millennials than previous generations

…

But saving up for a home can be hard to do when millennials are shelling out money for climbing rents in the meantime.

Rents increased by 46% from the 1960s to 2000 when adjusted for inflation. In 1960, the median gross rent was $71, or $588 in today’s dollars. In 2000, that number rose to $602, or $866 in today’s dollars.

The current median US rent, according to Zillow, is $1,600.

…

From the late 1980s to the 2017-18 school year, the cost of an undergraduate degree rose by 213% at public schools, adjusting for inflation.

Back then, average annual tuition for public college was just $1,490, or $3,190 in today’s dollars, compared with today’s price tag of $9,970.

Private college tuitions fared a little better, with a cost increase in the period of 129% when adjusted for inflation. In the late 1980s, it cost $7,050, or $15,160 in today’s dollars, for a private undergraduate degree. Today, the average cost is $34,740.

…

According to Bloomberg, the average worker shells out $5,714 for a family health insurance plan, or 30% of the total $18,764 cost — but five years ago, they were paying $4,316 of the total $15,745 cost, or 27%.

To put that into even more perspective, the average annual health insurance cost per person in 1960 was $146, CNBC reports. In 2016, it hit $10,345, nine times as high when adjusted for inflation. Costs are expected to increase to $14,944 in 2023.

Also:

I rag on millennials often. But to rag on them for their economic situation is completely moronic.

Everything has skyrocketed in costs, they are starting out life in massive debt, salaries are the same (or have fallen), and it’s increasingly difficult to invest effectively within the obviously manipulated markets.

There is absolutely nothing the generation could have done to offset this.

I am fortunate that I worked 1-2 jobs for about 20-40 hours a week while attending school full time for 6 years to get an Associates/Bachelor/Masters combination. I also networked extensively to be able to land a job after. I am also fortunate that I had boomer family members that were unlike others in the boomer generation. They were very giving and desiring that I live with them (even though as a young one I, like most of my age, wanted to leave right at 18).

My family would still let me move in and live with them right now if I wanted, as they have very strong family values. Instead of the “get out of my house at 18” values that became so prolific in recent years. Naturally, there is no way I’m going to do that. But to know my family has those values is nice. It helped tremendously when I was younger.

Even then, I started out making only a tad bit more than what a boomer could make straight out of high school when adjusted for inflation. This is with 6 years of work history & a M.A. in a high-demand field. I also still had around $15,000 in debt (which is small from the total cost – I paid off a big chunk by working full-time throughout school). It took me 3 years just to pay off that debt. I am just now reaching a position where I could plausibly buy a house in the near future.

This level of effort was not asked of previous generations. I did it, certainly. So it could be done. But to relate the different generations on an economic position is starting off on an incorrect logical assumption – which is that the conditions were the same between the two generations. They weren’t. One generation very clearly, and objectively, had a rougher economic upbringing. Boomers did not need to work two jobs at 60-70 hours a week to afford college, nor did they need to work full-time while attending school, nor did they need to forgo four years of earning potential to earn a degree or equivalent, nor did they even need to attend college to make enough money to buy a house in the first place, nor did they need to save for years to afford one single child. They just needed to graduate high school and work one job. That was it.

Many in the younger generations may have become soft and pathetic in response to the difficulties, but to deny that the difficulties existed would be a slap in the face of reality, not us.

Read Next:

Voter Integrity Project Proves Georgia Election Fraud

Follow The Money: Who Profits Off Of COVID? – Part 2

The Riots Strike Again: My Top 4 Riot Articles

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)