Most Recent News

Popular News

The US Dollar has conquered a lot of trials throughout the years. But what is coming next may not be so easy to overcome.

I recently touched on the inevitable fall of the petrodollar. Now, there is even more evidence to be at least somewhat concerned about the future of the dollar in a rapidly emerging multipolar world:

The Dominance Of The U.S. Dollar Is Fading Right Before Our Eyes

It was just a couple of weeks ago that I wrote an article arguing that the economic sanctions we have cast upon in Russia, due to its invasion of Ukraine, likely mark the beginning of a period where China and Russia would bifurcate the global monetary system, leading them to eventually challenge the U.S. dollar’s reserve status.

Now, Saudi Arabia is joining the fray, further threatening to tip the balance of the global monetary scales that have kept the U.S. dollar afloat for decades.

The fact that predictions of a “new economy” and “new monetary system” only exist on fringe blogs like mine and haven’t gone mainstream given the current economic situation with Russia (even amidst our abuses of printing the dollar over the last several decades) is baffling to me.

As I noted to Andy Schectman in a recent podcast, our quality of life in the United States and our nation’s entire economy is an elephant balancing, on one leg, on the toothpick of the U.S. dollar’s reserve status.

Our quality of life relies solely in our unique ability to import the goods and services that we use and need on a daily basis, while exporting US dollars. We’ve been able to print trillions of U.S. dollars into existence over the last couple of years – monetary policy that is anything but sound, regardless of whether or not your currency has global reserve status – because of the luxuries afforded to us by the dollar’s global reserve status.

But this reserve status, and the $30 trillion in debt we have accrued and convinced ourselves we will never have to pay, quickly go from being long-term liabilities that we can theoretically ignore to current liabilities that we must address if the dollar is ever legitimately challenged.

Short and to the point. That article is an accurate reflection of where the USD currently stands on the global stage. One gust of wind throwing off the reserve status, and we come tumbling down. Between these issues with our reserve status, the petrodollar, and our money supply, it’s no wonder many people are starting to panic.

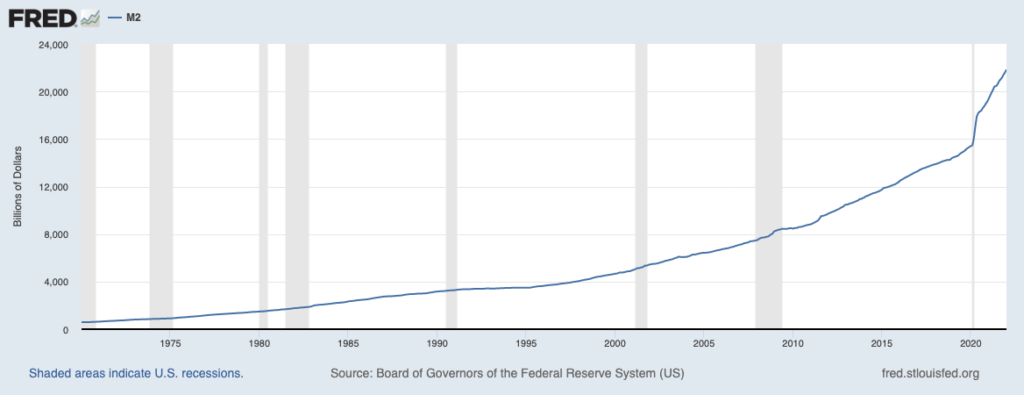

Just look at the money supply from 1970 (from FRED):

This is not sustainable indefinitely without problematic inflation, even ignoring the reserve issue.

An article by ZeroHedge also notes that Hedge Funds Sell Record 1 Billion Barrels In Oil Futures Just As Prices Explode Higher. That doesn’t seem like a great sign of optimism by our ruling class.

And if you think that the Fed can save or correct this through interest rate hikes, I’d explore that thought more fully:

What Can the Fed Do About the Price of Food, Medicine, Gasoline, or Rent?

The answer is nothing or next to nothing. Rates hikes will not impact inelastic items.

What the Fed Can and Cannot Do

The Fed cannot directly influence the price of anything because it cannot produce either goods or services.

The Fed can reduce or increase demand where demand is elastic by raising or lowering the cost of money.

Demand Destruction

I have often spoken of demand destruction by Fed rate hikes. Curiously, the primary demand destruction is not even in the tables.

Home prices are not in the CPI. Yet by hiking rates, the Fed will certainly cool the demand for housing.

With decreased demand for housing comes decreased demand for things like furniture, landscaping, carpet, etc.

By hiking rates, the Fed also reduces the demand to hold stocks. The price of equities drops. That also reduces the demand for housing, new cars, eating out, and travel.

[…]

This is why inflation Expectations theory the Fed abides by is total nonsense.

People will not rent two homes if they perceive prices will rise. Nor will people stop paying rent and wait for declines in they believe prices will fall.

The same applies to buying food, gas etc.

If you’re worried about inflation, you could take a lesson from our intelligentsia. They’re always looking out for our best interest, after all:

Professor: Hate inflation? Take the bus, don’t eat meat, cut back on pet care

[…]

If you’re one of the many Americans who became a new pet owner during the pandemic, you might want to rethink those costly pet medical needs. It may sound harsh, but researchers actually don’t recommend pet chemotherapy — which can cost up to $10,000 — for ethical reasons.

In summary, if you’re struggling with rising costs from ruling class stupidity, you should simply stop eating healthy proteins, cease driving anywhere, and let your dog die. That seems reasonable.

It’s amazing how distant our own ruling class is from our working classes. We live in two entirely different worlds. They don’t get it at all.

But the problem remains: We at the bottom do not have the financial or strategic security to weather a decimation of the dollar. They do. So we care, while they laugh and dictate from the ivory and gold towers.

Be cautious with your financial strategy over the course of the next year. The dollar is not looking good, and if we keep experiencing more issues like those that are plaguing us currently, we are certainly in store for some massive financial difficulties on the road ahead.

Read Next:

Social Media And Social Engineering

A New Narrative: Chemical Weapon Attack In Ukraine

The Fall Of The Petrodollar: Say Hello To Hyperinflation

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)