Most Recent News

Popular News

It's easy to have a housing crisis when you import millions of people, create rampant inflation, and then raise interest rates.

It’s pretty easy to have a housing crisis when you import tens of millions of people in a short period, allow mega-corporates like Blackrock to buy up single-family homes, create rampant inflation through asinine levels of money printing, and then raise interest rates.

If it’s not being manufactured, then we’re living under textbook definition morons.

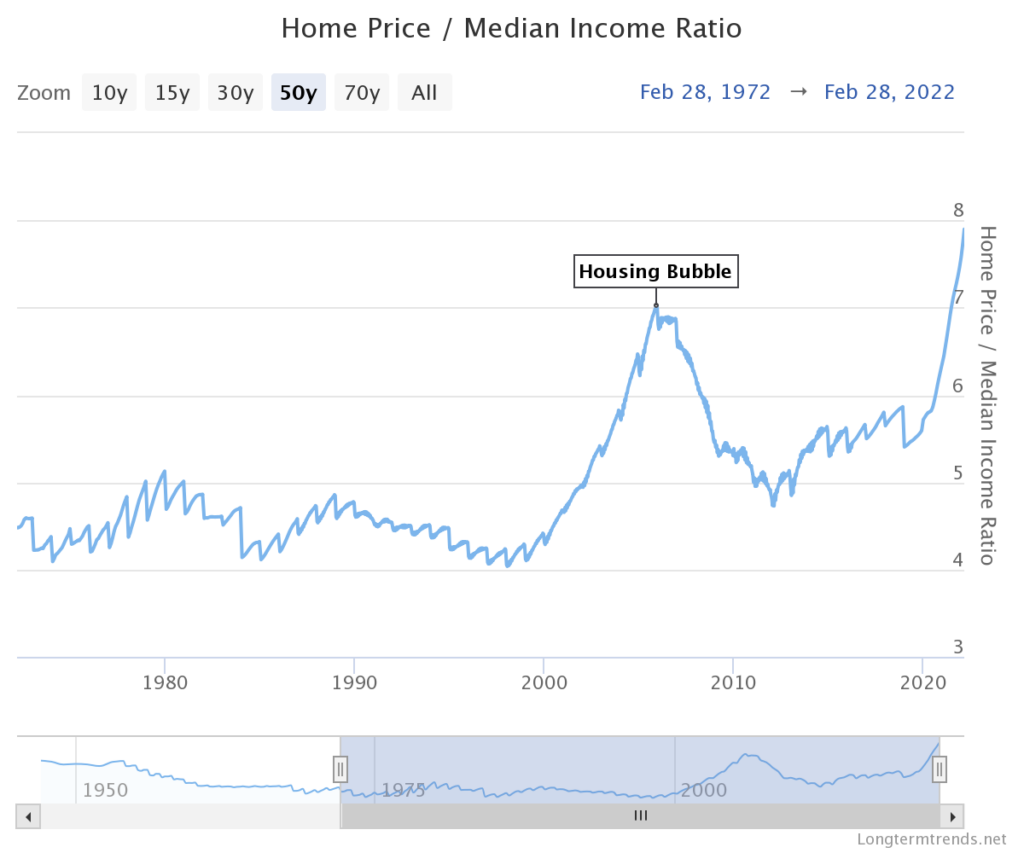

The best generation-analysis I’ve found is the median home price to median income ratio. See below for the past 50 years:

Historically, an average house in the U.S. cost around 5 times the yearly household income. During the housing bubble of 2006 the ratio exceeded 7 – in other words, an average single family house in the United States cost more than 7 times the U.S. median annual household income.

The last available data point was for Feb 2022 at 7.90 on the chart. It is certainly higher now, breaking 8 for the first time. The boomer generation was around 4-5. We’re near double that now.

The full situation is far worse, because this graph does not take into consideration additional costs like property tax and home insurance. Both of which cost significantly more for a $500,000 house compared to an $80,000 house. Interest rates for a $500,000 house are also significantly more prohibitive than for a $80,000 house, even if the overall rate is lower (10% of 80k is 8k, 10% of 500k is 50k – they are not equal). We also can’t leave out the fact that there are added complications of increased tax rates from twenty years ago in nearly every possible tax avenue (sales taxes, additional fed non-income taxes, state fees/car taxes, etc). Add all this together to paint a very dire picture in the form of this graph for our young folks, myself included.

This all points to a manufactured housing crisis. These events are not coincidental, nor are they accidents. The elites are not that stupid. It’s being done on purpose. They hate us and want to make us enslaved to the bank for as long as possible through mortgages.

Many people say that a housing crash is on the way. I’m not so optimistic. I’m uncertain that housing prices will drop, given the general inflation that has occurred. The elites have caused the inflation through money printing, and it’s not like that inflation will just crash or disappear. Inflation is permanent, so unless houses were overpriced before (which is possible), it’s unlikely to happen to the extent being forecasted. The house prices might stick around these prices, just with added interest rates now. Which is possibly the worst-case scenario for the first time home buyers, like I’d like to be before I’m 70.

But we should not complain too excessively about our situation. We have to take the hand that was given to us in life and move on. We younger folk have been getting annihilated financially since our initial incursion into adulthood, so nothing has changed. This is just another battle that we can, and will, overcome. These battles will only strengthen us and make us more “anti-fragile” in the long term. Keep a positive mindset and do what you can, even if you’re like me and that “do what you can” is doing nothing but keeping your head low and paying $1600+ in rent because you can’t afford a house right now but must take care of your family. Keep a good mindset, or clown world will destroy both your finances and your mind.

The housing market will certainly be in for some exciting times if they keep raising the rates, which it sure seems like they will be. No one with a mortgage will sell, and no one that needs a mortgage will be able to afford a $500,000 house with a 10% interest rate. It’s quite the odd mix. I guess only the rich and the old folks will be buying/selling houses for a while.

Interesting times ahead.

Read Next:

Food Inflation Incoming: The Trap Is Set

The Only Knowledge That Matters

The Hilarious Condition Of Our Elections

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)