Most Recent News

Popular News

Rest in pieces, Silicon Valley Bank and Signature Bank.

Rest in pieces, Silicon Valley Bank (SVB) and Signature Bank.

Two of the Top 50 largest banks in the United States just crashed (the second and third largest crashes in United States history, outside of only 2008).

Yet, as of today, the stock market as a whole is up. Clown world is really shining through today.

Jim Cramer, who is notoriously wrong about everything regarding the economy, previously praised SVB a month ago as “The biggest winner of 2023” and advised people to invest in it (“The ninth-best performer here today is SVB financial. Don’t yawn“).

Let’s see what other “experts” have to say:

“The banking system is safe”

Joe Biden

A few banks may have issues like SVB, but only a few. Govt actions removed reasons for bank runs. Biggest banks have much tougher regulation and stress testing. Anxiety and volatility high, but sharply lower interest rates, fed likely on hold, are strong positives for markets.

Lloyd Blankfein

This situation is not like 2008

Anonymous Treasury Official

Regional bank stocks are an incredible bargain now as long as the gov’t does the right thing, and I am confident it will.

This means that one of the great trades would be to buy regional bank stocks or ETFs here. And the massive decline in rates makes this an even better investment now.

Bill Ackman

If you trusted them before, maybe now is the time to start doubting.

There are plenty of other authors who have already provided a postmortem analysis for both banks. So I won’t do so here. But I can provide a brief summary for those readers where all this financial jargon goes over their heads:

If you want a more in-depth analysis, this is a good place to start. Just ignore their tunnel vision on precious metals.

What is of concern is that every bank has operated similarly in some fashion to SVB and Signature. Because of the previously low interest rate environment, many banks are tied up in similar types of securities (which would now need to be discounted at a loss if needing to sell).

The Federal Deposit Insurance Corporation (FDIC) cannot cover this alone. It is mathematically impossible.

The Deposit Insurance Fund (the “DIF”—which is what the FDIC uses to cover insured depositors) is only required to cover 1.35% of all insured deposits through this fund.

In 2020, for instance, the FDIC covered $8.9 trillion deposits and therefore, the DIF requirement was $120 billion. It hasn’t gone up much since then. I hear estimates saying $125 billion.

The other side of the coin is also currently undetermined, but the estimate is that 89% of its $175 billion in SVB deposits were uninsured. That is $155.75 billion.

The fund holds $125 billion. Unsecured deposits alone total $155.75 billion.

The FDIC cannot cover this one single bank failure (if including uninsured deposits) with their insurance fund. Not a good sign.

So, the ruling class is relying on a bailout to cover this major upcoming liquidity crisis. But they aren’t allowing it to be called a bailout.

How they are doing this is incredibly shady, and should provoke concern into the minds of anyone that truly understands what they are doing.

This is their strategy, as of today (Mar 13):

This means that people and businesses that have money at the bank will be covered, but not those who have other financial interests in the bank, such as stockholders.

Thus, they are bailing out the startups, VC holders, and other elites that have massive insured deposits at SVB and Signature. But they just don’t want to call it that to cause panic. And they don’t want a wealth flight of uninsured deposits to flee from all banks, which would happen if they do not cover these deposits. Because that would cause the majority of regional banks—and perhaps even the big players—to also crash.

But the problem is that they do not have the money to do so. I just demonstrated that with the DIF. They need outside support. Therefore, the FDIC just got cucked by the Treasury and the Federal Reserve. They are functionaries under them now, whether or not that is constitutional.

The rulers are also claiming that “no taxpayer money will be spent for this [bailout]”. But that is completely malicious and blatantly untrue.

The ruling class claims that other banks will pay for this through a “special assessment on banks”:

All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Federal Reserve

But this is an indirect hit on anyone that has money in the banks. The banks won’t pay for this themselves, they will have to push the cost on to their depositors. Apparently, to the Federal Reserve, people with bank accounts are not “taxpayers”.

It’s a stupid play on words. It’s exactly like what these monsters do with inflation—They don’t call it a tax, but it is still an indirect tax.

They aren’t printing money, but the average person will still get hit by this, either through loan interest increases, more bank fees, or other reclamation efforts by banks. And the money will go to woke Silicon Valley startup firms, risky regional banks, big businesses, and the rest of these uninsured depositors. And the final payee will be anyone that interacts with a bank in any capacity (i.e., taxpayers).

But the comedic part is that they have no choice. If they don’t, all of these regional banks—and those with vested interest through uninsured deposits—would come tumbling down.

It’s a bailout helping the big guys by harming the small guys, no different from 2008. Even if they deny it.

Our monetary policy largely caused this, along with improper incentives given to banks. While I understand the usefulness of blaming Biden for it, he is but a small piece of the puzzle. This monetary policy issue has been ongoing for decades, but especially during the Obama years.

And it’s only going to get worse, because the underlying root issues are not being fixed. Covering depositors in two major cataclysmic crashes does not solve the reason why they crashed.

It’s only going to get worse from here. This is just an attempted covering up of the problem, for now.

This is especially true because now the Federal Reserve is in quite the conundrum. To put it simple:

Or:

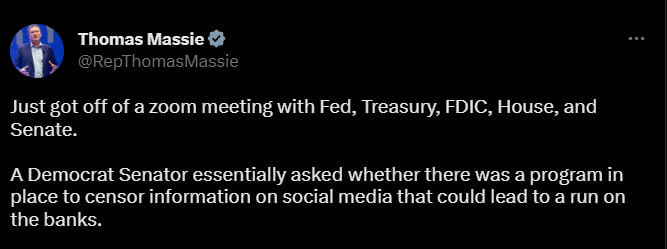

They are truly stuck. They are also panicking:

I don’t really see how they are going to get around this. My bet is that they will slow the interest rate increases, which means things are about to get a lot more pricey. Plan accordingly.

Now it is Monday and other similar banks are crashing so hard in stock prices that they had to halt trading to prevent a complete meltdown:

But what is more worrisome is the nonchalant attitude of many. I don’t think they recognize how fragile our system is, that we could have two of the top 50 banks crash within three days, which requires the Treasury to step in to prevent a total bank system failure.

That is how weak and frail our banking system is. But many do not seem to “get this”.

These are not the only two banks with these issues. All banks have taken part in this racket, because the Federal Reserve incentivized it for years. This situation is a ticking time bomb.

It doesn’t help that the ruling class has already been setting itself up for a transition to the Digital Dollar. Weird timing is all I am saying.

Covid started in March. Maybe they’ll keep the trend going of artificial crises starting in March.

They did tell us the plan was to “never go back to normal”:

2023 is certainly setting itself up for some major changes.

I recommend getting caught up on my strategy for preparation, if you have not already:

Try to hedge while/if you can. With a banking system that is this fragile, it only takes a little push to bring the whole thing tumbling down.

Read Next: The Nord Stream Pipelines

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)