Most Recent News

Popular News

Who benefits from the Fed's non-stop money printing? Inflation is incoming. Prepare yourself now.

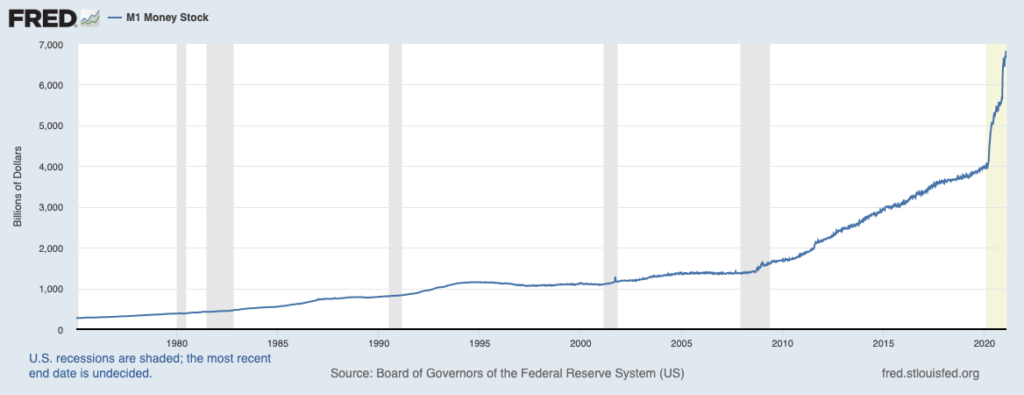

Because clearly this is going to end well:

(as always: Right click -> view image for better view)

Brace for impact.

Also, for those that don’t yet understand why inflation is always in the interest of centralizers, this article from ZeroHedge sums it up nicely:

Today we share with you what the Fed, media, and Wall Street will not. By doing so, we help you decide if inflation is for the greater good.

What is Price Stability?

Congress delegates responsibility for monetary policy to the Fed but maintains oversight. They are supposed to ensure the Fed adheres to its statutory mandate of “maximum employment, stable prices, and moderate long-term interest rates.”

In July 1996, Fed Chairman Greenspan opined on the definition of price stability. He stated- “I would say the number is zero if inflation is properly measured.”

In a paper from 2006, Fed economists Robert Rasche and Daniel Thornton lend credence to his opinion: “In so doing, he (Greenspan) confirmed that the rate of inflation that results in the maximum sustainable growth rate of output is zero.”

So if stable prices mean no inflation, why does the Fed crave more inflation?

Why Inflation?

Debt is the principal reason Fed members are increasingly troubled with low inflation. Debt has increasingly become an economic engine. Some of it went toward productive purposes. Most of this debt results in growth and pays for itself. Slowing productivity, GDP, corporate earnings, and wage growth argue a large percentage was put to non-productive use.

Non-productive debt boosts economic activity for a short period. That is what makes it attractive to the Fed in times of sub-optimal economic growth. The flaw of this logic is that it does not produce enough income to pay off future debt. Accordingly, it weighs on future economic growth and requires ever more debt to keep the economy rolling.

Currently, there is $83 trillion of total debt outstanding, powering a $21 trillion economy. Include future liabilities such as social security, and the amount of debt nearly doubles.

Solving A Debt Problem

The Fed shuns options one and two above. Austerity would squash economic growth, which the Fed and lawmakers will not tolerate. Defaulting on a moderate share of debt will devastate the financial markets and hurt the economy. While both options require severe short-term pain, they promote more robust growth in the future.

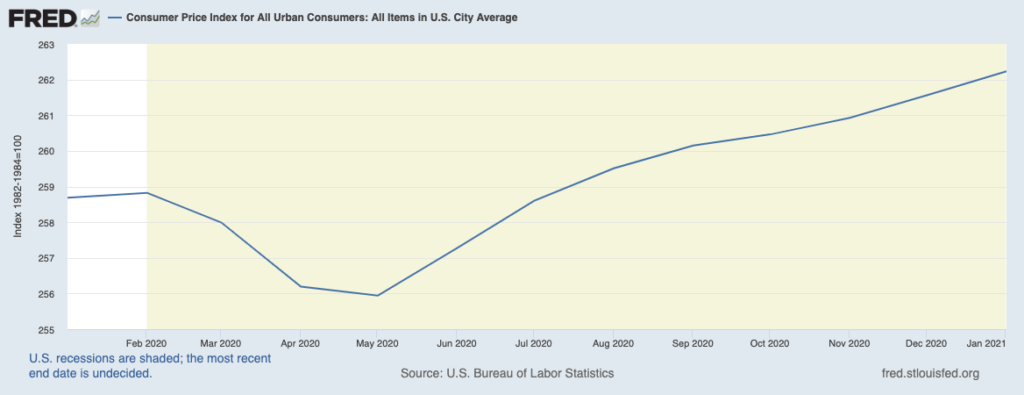

That leaves inflation. Inflation deflates the real value of debt. Higher wages, profits, and taxes resulting from inflation make debt payments less onerous.

The Fed is trapped. They want robust economic activity and soaring asset prices. In the current environment, this can only occur with more debt and leverage. To make existing and additional debt manageable and appealing, they must reduce interest rates.

Summary- Is Inflation in the Greater Good?

Now you know why the Fed desperately wants you to pay more for milk, butter, eggs, bread, and toilet paper. They are deep in a trap of their own making. They can keep digging deeper into the trap, or they can change their ways.

Despite rhetoric to the contrary, change is not politically palatable to the political ruling class on both sides of the aisle. As such, years of fiscal and monetary negligence leave the Fed with one option- inflation. If the Fed does not make us pay more for goods and services, the scheme comes to an end.

So again, brace for impact.

The system is not sustainable enough to last long-term. The ramifications of these actions are coming within our lifetime.

Read Next:

Stock Traders Figure Out That Centralizers Exist and Are Not Their Friends (Saturday Special)

Follow The Money: Who Profits Off Of COVID?

Where Your Taxes Go: The Government Waste of 2020

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)