Most Recent News

Popular News

There's a common argument that goes like "if you don't like socialism then reject your social security benefits". I discuss why this is a stupid argument.

There’s a pretty hilarious argument online that usually goes like this:

If you don’t like socialism then you should reject your social security benefits.

Now I know for most of you this (rightfully) seems like a trolling attempt. But I have bad news. There are actually quite a few people who think like this.

After I posted my last article, “Let’s Expand Social Security!” Says The Fiscally Illiterate, I received so many people hurling this one at me. People on their actual accounts. Clearly not trolling.

So then I went further to see if this was a common thing across social media. I found out it’s real and quite a common quip when someone sh*t talks socialism. A bunch of people actually believe this.

It was painful to realize.

But anyway, now I have to debunk it.

If you catch someone making this argument, send them a link to this article!

The argument largely states two things:

I agree with number 1. Social security is a socialist program. In the 1930s Franklin Roosevelt brought over some German socialism in the form of social security. Surprisingly, Americans lived for 150 years prior to it being enacted just fine. But let’s not get into that.

There is a fundamental problem with number 2, however. That problem is we don’t really have a choice.

Sure, we can opt to not receive the benefits. But we can’t opt to not pay the benefits.

This argument would make sense if we could opt out of supporting social security. But we can’t. It’s taken at gunpoint if we try.

The argument lies on me being a hypocrite by using social security. Yet, it’s not me “utilizing the socialist program for my benefit” as they make it out to be.

It’s me trying desperately to reclaim some of the money back that it stole from me in the first place.

I have to take social security because it takes so much of my paycheck that I can’t save as adequately as I could without it.

You want to know why seniors have no savings? Because the government taxes the hell out of them their entire lives.

The government, on both the left and the right, impoverish people through funding these types of socialist programs. They then turn around and say “well, we need to increase social security because seniors don’t have any money left because we took it all for other social programs“.

Idiots.

Scary, scary math.

We will take social security because they took so much earning power from us that made it impossible to save as much as we should have.

Like I said above, if I could opt out I would in a heartbeat. Why? Here’s why:

The current tax rate is 12.4% for social security. You pay half, your employer pays half. If your employer didn’t have to pay this, they could pass it along in increased income. Your defacto paying 12.4% every year.

You pay 12.4% for your entire working life. If you take social security at 65 and start working at 20 that’s a fun 45 years.

The median income in the U.S. is $63,179. That means each year the median American will lose $7834.20 to social security. (That is 12.4% of $63,179). (Naturally, there would be some fluctuation in earnings throughout your life but we simplify this equation at the median).

Over 45 years (7834.20×45), they would pay $352,538.82 into social security.

And guess what? You’re not getting that back.

If you took social security at full retirement age (which is only going to go up as social security is an unfunded liability) of 65, you’ll get (on average) 13 years of payments.

Why 13 years? Because the US life expectancy is 78 years old.

The average payout is $1,503 per month. That’s a lackluster $18,036 annually. Or, $234,468 lifetime payout.

So you’re paying in $352,538.82. And if you’re lucky getting $234,468 out.

Hold on though! We can’t forget compounding interest.

You’re not just losing that payment of $352,538.82. You’re also losing out on the investment potential of that amount.

You likely wouldn’t just take that extra money and put it in a 0% savings account. You’d invest it like we do with 401k’s and savings account.

So each year we lose the $7834.20 we pay in tax that could go toward this retirement savings account. For 45 years.

The stock market return rate since its inception in 1926 through 2018 is approximately 10%. Since adopting 500 stocks into the index in 1957 through 2018 it is roughly 8% (7.96%).

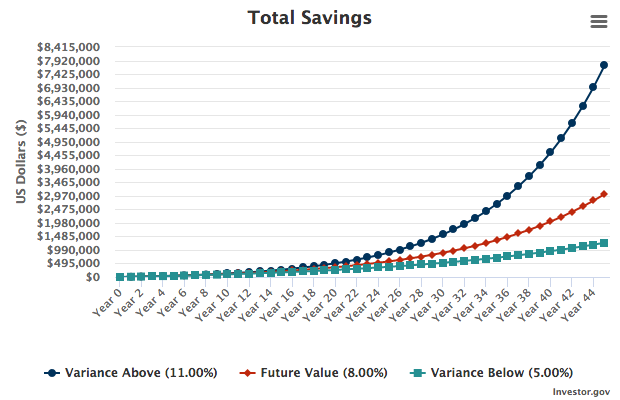

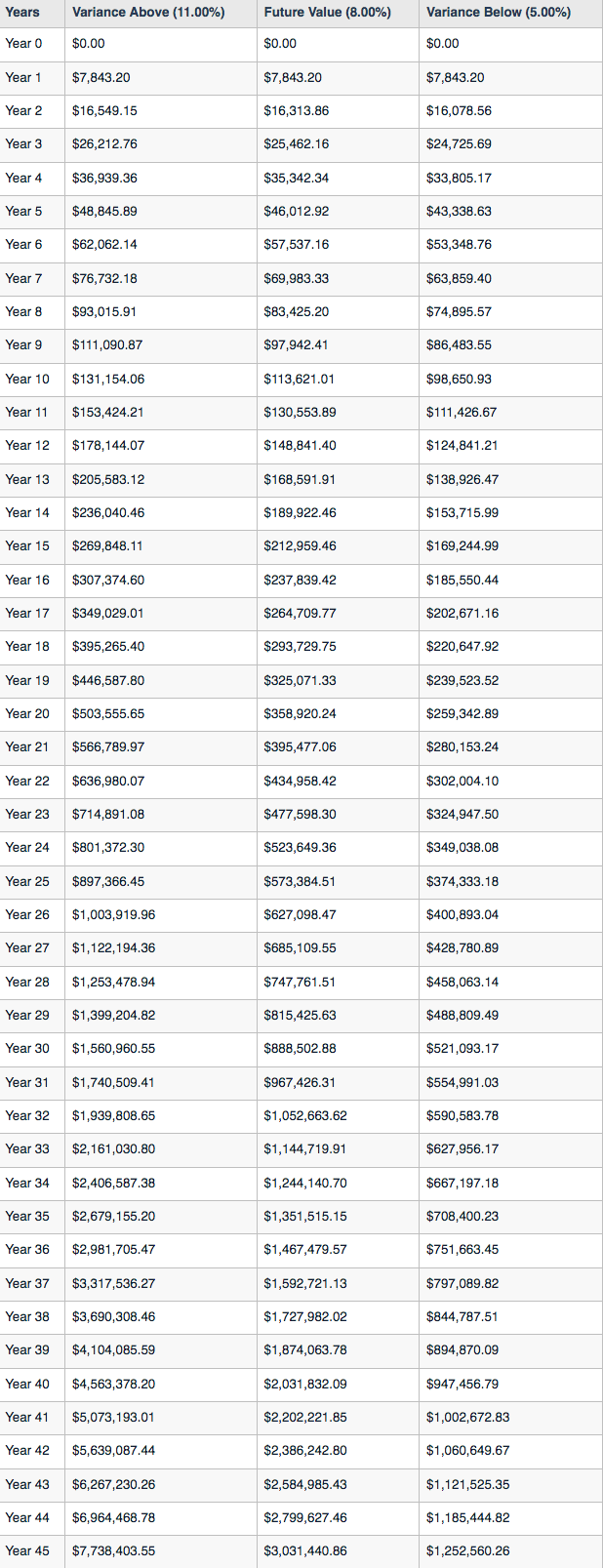

Let’s use the low rate of 8%. If you took that $7834.20 and invested it every month ($653.6 per month, starting with 0):

You’d have $3,031,440.86 by the time you were supposed to take social security at 65.

Yes, 3 MILLION DOLLARS.

See for yourself:

Even if the market did terrible, and you only got a 5% return, you would still retire a millionaire.

If the market outperformed, you’d be well past yacht status (~8 million).

Instead of this amazing savings opportunity, you only get $234,468 from social security.

So social security, at a market rate of 8%, actually costs the average American $2,796,972.86. (Your lost opportunity cost – expected social security payouts).

Even at a 5% rate it costs them over a million dollars.

Even if you consider the average benefits of a couple, it’s not much better at $29,932 annually or a lifetime payout of $389,116. How does a family payout of $389,116 compare to the potential payout of nearly $3 million dollars? And that’s only when considering the median income. The higher your income increases, the more social security takes away from your future.

Now consider that the social security age is going up and they are talking about decreasing future benefits. Still sound like such a great socialist deal?

So, should I reject my social security benefits because I don’t believe in sh*tty socialism?

Nah. I should take them to recoup a dismal amount of the millions I lost by being strong-armed into paying into this ponzi scheme in the first place.

And while I am taking them, I’ll continue to yell at all of you about how much money you’re losing by falling into this trap.

Ah hell, who am I kidding? I’m a millennial. Social security will run out long before I could even claim a dollar.

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)