Most Recent News

Popular News

It is really not that difficult.

Fixing the housing crisis is really not that difficult, if our leadership actually cared to do so.

In fact, I can sum it up in three steps:

Why these three? Let’s review.

According to the Statista Research Department, there were nearly 141 million homes in the United States in 2020. U.S. population was around 334 million when I checked on March 27, 2023. Probably around 12 million of those are illegals. Even if we include them, that’s still only a little over two people per home. Most family sizes that would be able to own a home already have a person, their spouse, and at least one child. Many have numerous children.

The point I am trying to make is that we do not have a supply issue, no matter how much the economists whine about it. We have plenty of houses. Instead, we have a centralization issue.

Wall Street has purchased millions of single-family homes since the Great Recession.

That is not an exaggeration. Private equity has bought up a significant chunk of available housing and turned them into high-priced rentals, unavailable for sale. Or they flip the houses by increasing the price and reselling them.

Some big names in this charade include:

And Wall Street is not the only institutional investors in the game. Many private equity firms are in on it (home flipper organizations, online home-buying companies, et cetera).

The sheer amount of purchases is incredible:

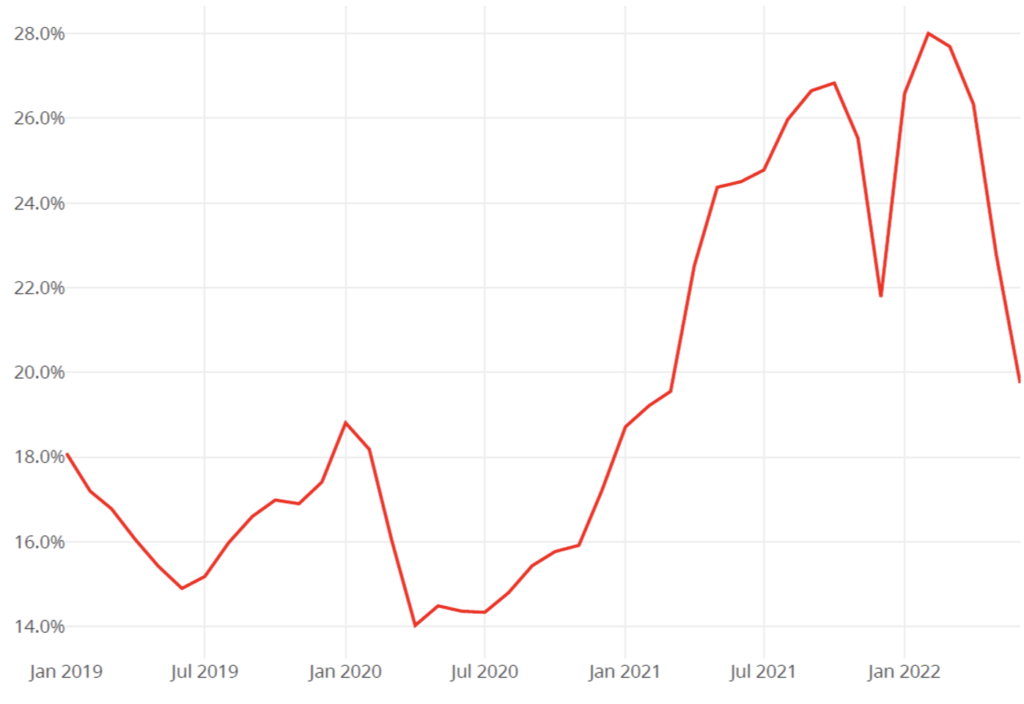

Investors Bought a Quarter of Homes Sold Last Year, Driving Up Rents

Investors bought 24% of all single-family houses sold nationwide last year, up from 15% to 16% annually going back to 2012, according to a Stateline analysis of data provided by CoreLogic, a California-based data analytics firm. That share dipped only slightly in the first five months of 2022 to 22%.

Investor purchases doubled or more in Florida, Nevada, Vermont and Washington state from 2020 to 2021. In Vermont, they grew from 7% of sales in 2020 to 17% last year and in Nevada from 18% to 30%.

Five states saw the highest share of investor purchases. Investors bought a third of single-family homes sold in Georgia (33%) last year, with Arizona (31%), Nevada (30%), California and Texas (both 29%) not far behind.

Investor ownership began to grow after the Great Recession of 2008-2009, when large swaths of overbuilt Sun Belt homes went into foreclosure, and investors snapped them up. Investor ownership grew again last year as pandemic-related demand for suburban housing rose, and investors saw a chance to win bidding wars with cash offers.

MetLife Investment Management expects institutional investors may control 40% of U.S. single-family rental homes by 2030.

It is a little hard for a family making $80k a year to compete with a multi-billion dollar private equity firm when buying their first home.

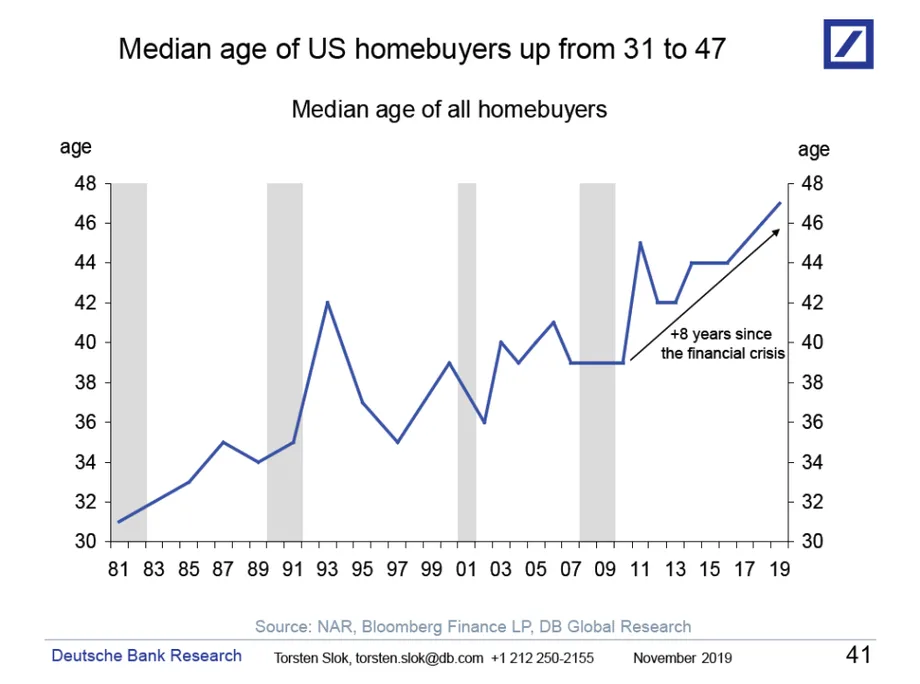

This is why the median age of homebuyers has increased:

These institutions are actively buying homes and permanently shutting those homes out of the home-buyer pool (or increasing the cost), thereby creating lifelong renters. And no one seems to get this.

It is all these private equity firms that are causing the housing shortage. Nothing else contributes anywhere near as much.

If builders build more houses, these subhumans institutions will just buy more of them.

We’re in a perpetual state of housing crisis until we fix the issue of private equity. That can only be fixed by fixing the banking system, removing their incentives (current flat property taxes that allow them to benefit by buying so many homes), and averting hordes of illegals flooding the border requiring the illicit rentals that these institutions own.

Fix those issues, and you immediately fix the housing crisis. We do not need more builders, we do not need state financial assistance, and we do not need higher paying jobs. We just need the private equity firms to go (you-know-what) themselves.

So, to recap, the institutions:

When they say “you will own nothing and be happy,” this is exactly what they mean. You cannot own anything if massive private equity firms outbid you. Which they will, every time.

Our leaders do not do these simple steps because they are bankrolled by those who profit from it. Just like most of our other issues that only exist because they are profitable to the elites.

Nearly every fiscally responsible family in this country can have a home right now, just like the boomers did, if we simply stopped the centralization by institutional investors.

Again: We do not have a supply/demand issue. We have a centralization issue.

Read Next: The Basic Principles Of War Propaganda

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)