Most Recent News

Popular News

An economy update for November 2018. A quick, easy read into the important indicators of the US economy. How is America doing?

Consumer Confidence

Consumer ConfidenceConsumer optimism in the economy had a slight rebound from last month. Overall, consumers are still very confident about the economy and their own personal finances.

End of October the index was 101.4, which is up from previous readings and compared to other countries that have dipped below 101.

Likely, this small increase is tied to the stock market getting back into a good groove.

Inflation has gone up as I talked about in the last article.

Fed is expecting consumer inflation to stay just a bit above 2% going forward, so plan accordingly with your investments/savings accounts.

House prices continued to rise, but the overall rate of appreciation has started to decline.

It is likely that goods and house prices will continue to rise throughout the year. The National Association of Realtors (NAR) is anticipating that home prices will increase 4.8% overall in 2018 and 3.5% in 2019.

GDP in Q3 is at 3.5

For comparison, it was an amazing 4.2 in Q2, and 2.2 in Q1. So we’re still seeing amazing gains and an overall good economy.

Real earnings took a nosedive in Q4 2017, but they have since started to rebound.

In Q4 2017, they were 345 (1982 adjusted dollars). They are currently at 355 for Q3 2018.

At the end of October, average hourly earnings growth reached its highest level in nearly a decade!

Recent wage gains are outpacing inflation and worker pay (adjusted for inflation) is still growing.

It is growing at a smaller rate than when inflation was close to zero a few years back, but overall this is still a solid indicator in the overall health of the economy. Unemployment is down, businesses are being forced to pay more. This pay is greater than inflation = good for us.

S&P 500 has started to recover from that mad dip in October, exactly as anticipated in the last article.

It was at $2641.25 on Oct 29, and has since grown to $2736.27 as of November 16th.

I am expecting it to continue to rise as more people want to buy things in the upcoming holiday season, increasing consumption and faith in investments (as the cyclical cycle usually goes during this time of the year).

Unemployment in the US continues to hover around 4.0%. No expected deviations as of right now.

It is very low compared to the last couple of decades, so let’s hope it stays that way. Less unemployment, less crime.

Crude oil cost fell again this week (third week in a row). It is now at $57 per barrel (a decline from almost $8 from last month).

Regular gasoline declined about $0.20 as well. It is now at an average of $2.69. Unless you live in a city in California, in which case it’s still ridiculously expensive.

I’m pretty optimistic looking into the end of the year 2018. What I said in the last article still applies:

Typically, consumer spending increases dramatically as the holidays arrive. This will help numerous sectors that are lacking in the economy and help with the stock market rebound as consumer spending skyrockets.

I doubt we’ll see much of a change in house sales going into the future, however. The rising interest rates by the Fed and constantly increasing prices are only going to drive down demand. Well, there may be demand, but the people that want them can’t afford them.

It’s good news seeing real earnings up (more money for us!). And likewise good seeing unemployment down (less crime for us!).

Inflation does not appear to be slowing any. Hopefully, this can be reined in during early 2019.

Overall, we’re at a solid spot right now. My prediction is that it is likely upward from here, entering the rest of 2018.

Looking forward to 2019, we may have more concerns.

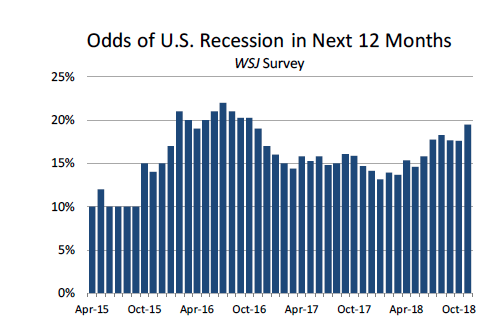

A survey done by forecasters anticipates a 1 in 5 chance of a recession occurring in 2019. This is never usually that high. Likewise, an even higher chance is anticipated for a recession occurring by 2020.

See the chart:

Keep your eyes on this going forward. It’s been jumping up pretty steadily since 2014. And we haven’t seen a major recession in quite a while. We’re starting to come due for one.

I’m not entirely sure if it will be in 2019, but I’d nearly guarantee it by 2025. The economy is very cyclical, it will happen eventually. Just stay watching for the indicators.

Thanks for stopping by.

(Learn More About The Dominion Newsletter Here)