Most Recent News

Popular News

An economy update for February 2019. How is the US economy doing and where are we heading?

Increased nearly 2.6% at an annual rate in Q4, slowing from 3.4% in Q3.

Over the entire year, real GDP grew 3.1%, up from 2.5% during 2017.

Also went up, but only by about 1% in December.

But it’s still good news compared to last year, which showed a decline.

Rose 9.7 points in February (to 131.4, basis of 1985=100).

Largely dropped in the prior months due to the government shutdown and the steep drop in equity markets at the turn of the year. Now, it’s heading back up. Expect it to keep rising.

New homes are not being created at the previous speed. Single-family housing starts increased 1.9% to 868,000. Compared to 8.5% in 2017. Forecasts expect this to decline even more during 2019.

However, sales of existing homes jumped 4.6% just in Jan, with all regions of the US noticing this change. The forecasters are projecting an overall decline of about 1% this year, though.

Real GDP growth accelerated in 2018. The consumer sector has been the biggest driver.

Consumer confidence is still high, but has fallen due to the issues mentioned above.

Housing affordability declined significantly last year, as mortgage costs climbed and house prices outpaced income gains.

Homeownership rate rose a very small amount last year. However, it is still near a 50 year low due to the insane costs.

The average S&P rose 0.4% in the financial markets this week.

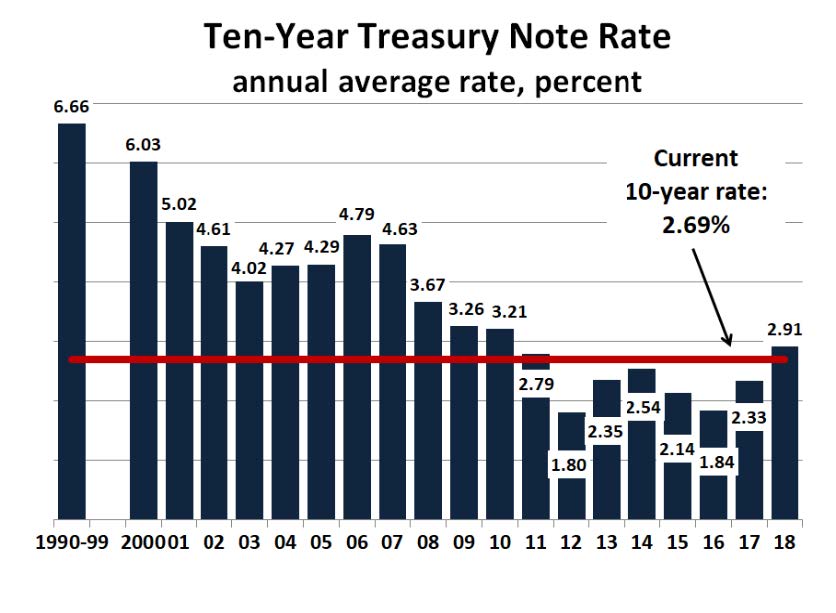

The 30-year mortgage rate also remains constant at 4.35%.

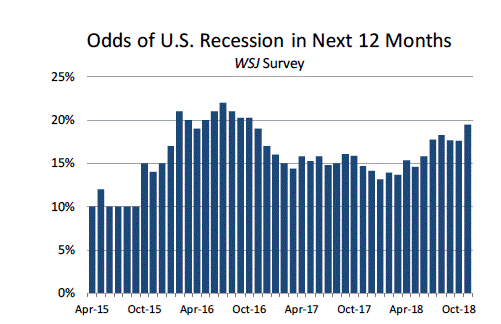

A survey done by forecasters anticipates a 1 in 5 chance of a recession occurring in 2019. This is never usually that high. Likewise, there is an even higher chance for a recession occurring by 2020.

See the chart from my last economic update article:

(Learn More About The Dominion Newsletter Here)