Most Recent News

Popular News

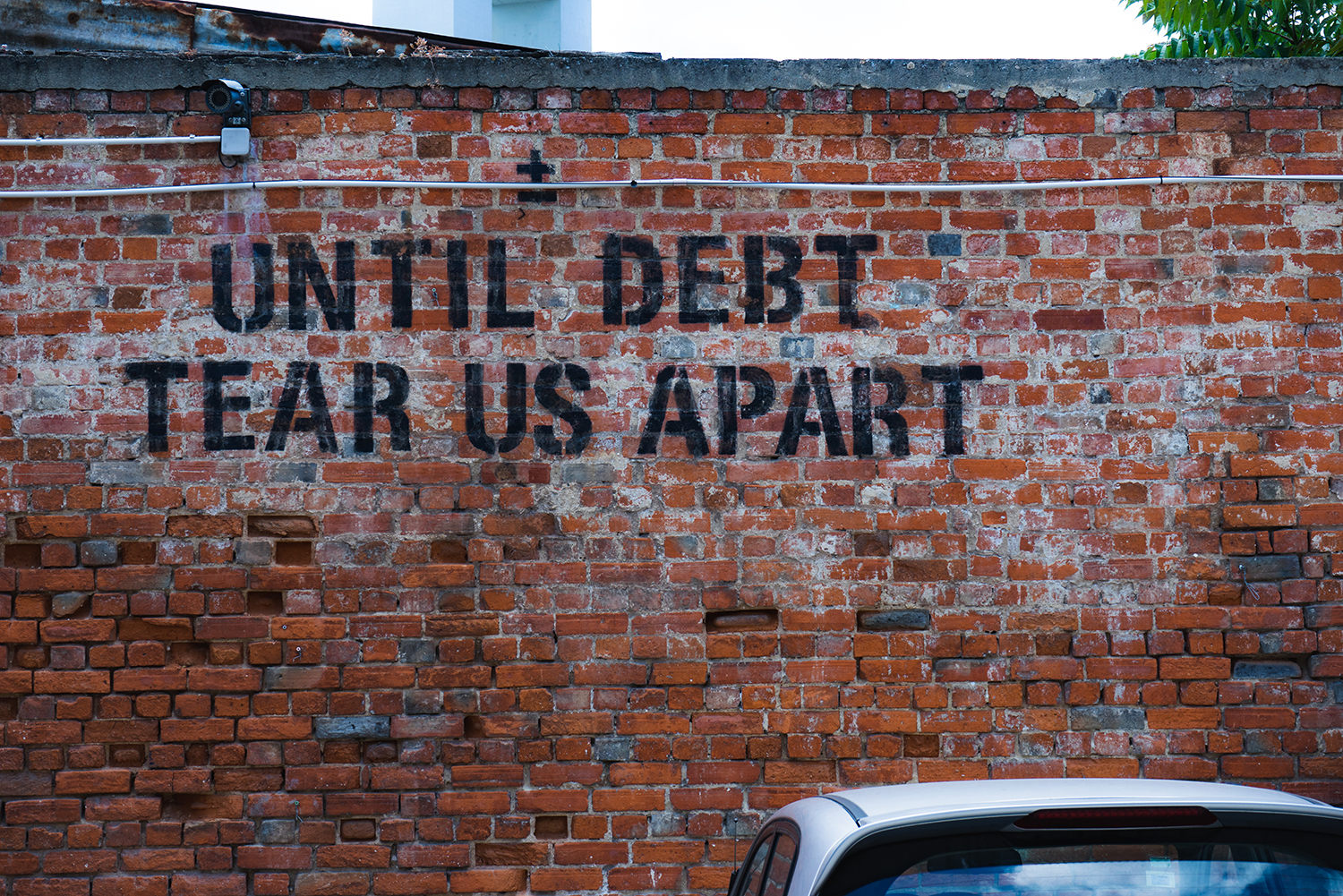

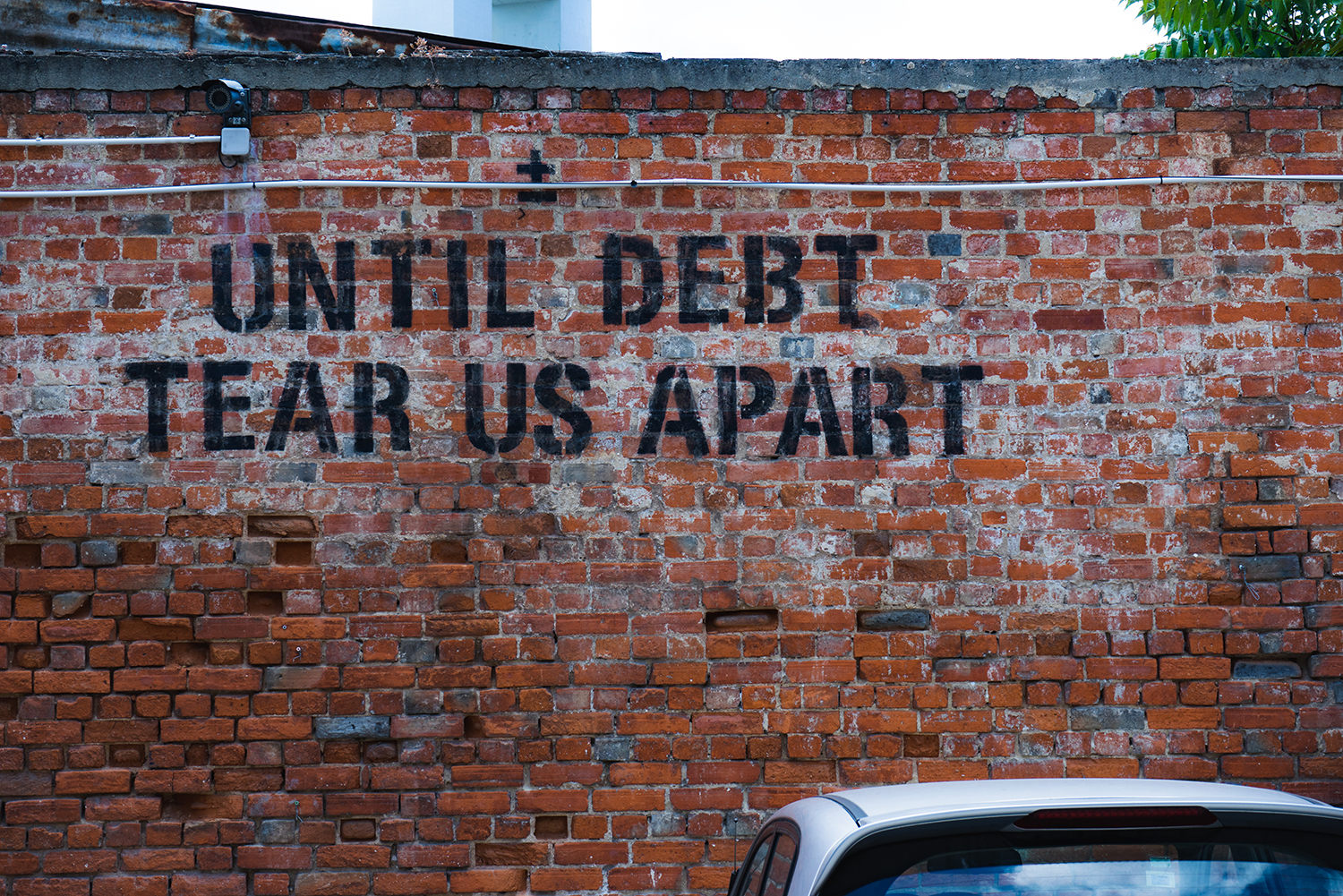

There is a new trend to call many forms of debt as "good debt". Too bad that's just another ploy to get people to spend money they don't have.

The ‘Good Debt’ Debate

There is a trend I have been noticing recently on the financial blogger platforms. Many people are talking about how Americans should take on “good debt” as it helps the economy and is a benefit to the debt-holder. That’s a bunch of garbage. The only good debt is the debt that you have already paid off.

The ‘Good Debtors’ are definitely a problem with capitalist societies. Or at least the capitalist mindset regarding debt and spending. The argument usually goes like this:

The reasoning behind why the bad debt is bad is self evident. Credit cards and personal loans have insanely high interest rates and are usually not essential, like a home or a car. HELOCs are bad because they are leverage against your home and could cause foreclosure if not paid. Auto loans are problematic because of high interest rates, significant loss of value and deterioration, and added charges like finance charges and GAP.

Then come in student loans, mortgages, and business loans as the fun, healthy loans. Supposedly, student loans are good because of the return on investment. Mortgages get a pass because of investment potential and necessity for housing. And business loans slide under the radar because typically there is no other way to fund a larger business idea.

Sadly, these are really lame arguments.

Kids graduating with $30,000 – $60,0000 in debt for a college education just to work at Popeyes is not a good “investment”. Student loans are terrible. They straddle the next generation that has little to no working experience with debt that they will be paying off for the next decade, if not longer.

Most of the kids 18-20 don’t even realize the kind of responsibility that $40,000 in student loan debt is. And then we have all these people saying how it’s “good debt”. Being stuck with tens of thousands of dollars in debt to anyone for any reason can never be a “good” thing.

Their earning power may increase depending on the field of study, but even that doesn’t mean that student loans are “good”. There are also no guarantees that it will increase earning power if you get a worthless degree. But you’re still stuck with the debt! They are better described as a “necessary evil” instead.

If you can’t afford college, you have to get them. But being branded as good is highly dangerous.

If they are a necessary evil, it makes much more sense to minimize them. Young kids aren’t going to hear something is good and try to minimize it. Evil? Sure.

There are also flat out better ways to do the college thing. Start by paying your way through community college. Then live with relatives for the last 2 years at a university. Minimize the debt so you can pay it off as fast as possible. Or just work first and save up money to pay as you go, taking no debt.

There is no difference (in “debt” terms, there are plenty of differences in other terms) between a car loan or a student loan. It is still money that you don’t have that is causing you to pay interest, losing additional money in the future. If you didn’t have to pay the student loan, you would have a lot more money that is instead going to interest.

Certain debt gurus consider real estate loans as “good” debt because you are building equity in an expensive item that you could not typically buy outright.

The same failed logic we saw from the student loan argument is also evident here. The “it’s an investment!” people. Apparently they have not heard about 2008. It is an investment. But a safer investment would be one without the debt on it.

However, there is another argument that comes up that is somewhat specific to mortgages: the tax argument. Good Debtors say that using a mortgage is great because then the IRS is subsidizing your house by giving you tax writeoffs for the interest paid.

But this is such a stupid argument. If you pay $3000 in interest, you’d be lucky to get a $300 tax break. This benefit is only as good as you can get above the standard deduction, which Trump raised significantly. The IRS isn’t subsidizing your principal at all.

If you weren’t paying the mortgage through debt, you wouldn’t have to pay the $3000 in interest to begin with. You save far more by not having loans to begin with. Basic math works wonders sometimes.

It is true that it is nearly impossible for most of us to buy a house outright. I sure as hell couldn’t. But it doesn’t mean that this form of debt is good. You could realistically end up paying 6 figures in interest payments that you otherwise would have saved for yourself without this debt. The goal of any debt should be to remove that debt, mortgages included.

I’d rather spend my money on my mortgage than someone else’s, but I’m not happy with interest, regardless. A 10, 12.5 or 15-year mortgage will save you tens of thousands of interest over a 30-year mortgage. That is good. The debt itself isn’t.

The simple fact is, if you can’t afford at least a 15-year mortgage you shouldn’t have a mortgage yet. A 30-year mortgage is a terrible investment and debt strategy.

You can’t reasonably start a business without a hell of a lot of capital or a loan.

But you want to know the main reason businesses fail?

Because they run out of money. They default and have to go bankrupt on their loans. It’s hard starting a business. It’s a lot harder when you have a massive principal and interest bearing loan every month.

The only thing these loans do is straddle the business owner further, requiring much higher profit margins to survive than would otherwise be necessary. That’s not good, that’s terrible.

It is required sometimes though, just like student loans. Doesn’t mean it’s good.

This is practically the same argument as the student loan and mortgage argument above, but using a business as a front for it. Regardless if you have a business or it is a personal loan, debt is still debt. It’s an instrument that you have to pay back with finance charges and interest. If you didn’t have it, you wouldn’t have to pay the additional expense of borrowed money to begin with, netting a much larger profit.

Investing in the stock market or other avenues (such as a business investment) is a risky endeavor when you could pay off the loan and guarantee a realization of the interest rate you were already paying.

The goal of any business should be the same of any individual: to pay off the loan as fast as possible to save money on the interest. This one doesn’t even have personal tax write-off benefits like mortgages. Yuck.

In summary, you cannot owe some institution money and consider it a good thing. It may be necessary, but not everything necessary is good.

No debt is good debt.

(Learn More About The Dominion Newsletter Here)