Most Recent News

Popular News

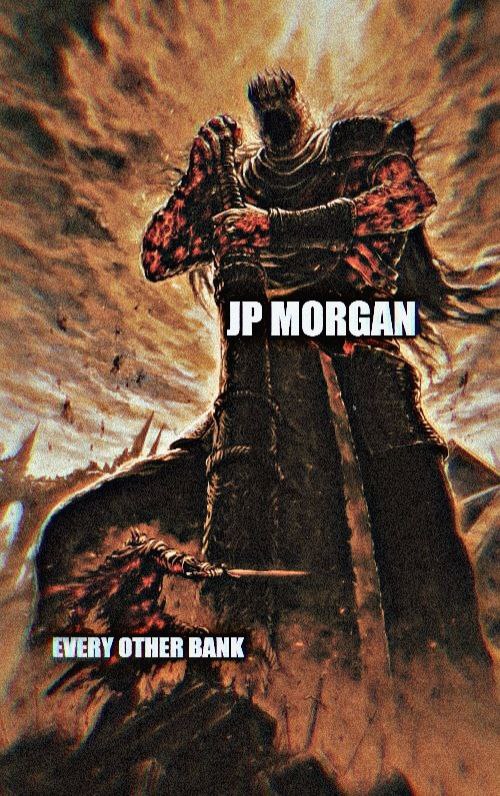

Regional banks are falling like dominos.

First Republic Bank is now history.

JPM CEO Says “System Is Very, Very Sound” After Second Largest US Bank Failure In History

After another massive bank failure – and taxpayer-funded bailout – JPMorgan CEO Jamie Dimon told listeners on an investor call this morning that “The system is very, very sound.”

Doesn’t seem like it Jamie, old chap?

But hey, whatever you say now as the CEO of a bank that holds over 10% of America’s deposits.

[…]

Dimon’s closing comments were the most prophetic, stating that they “support community banks” and that “banks will consolidate.” Of course they will, once the banks are pushed into FDIC hands and assets scooped up by JPM with govt bankstops…

Translation: We will wait for the bank run (thanks Fed for the hike to 5.25%) to cripple them all, then buy them all for cents on the dollar with the FDIC keeping the toxic crap.

JP Morgan’s system is very sound, given that they are profiting immensely off of these failing regional banks. But that does not mean our system is sound. Quite the opposite.

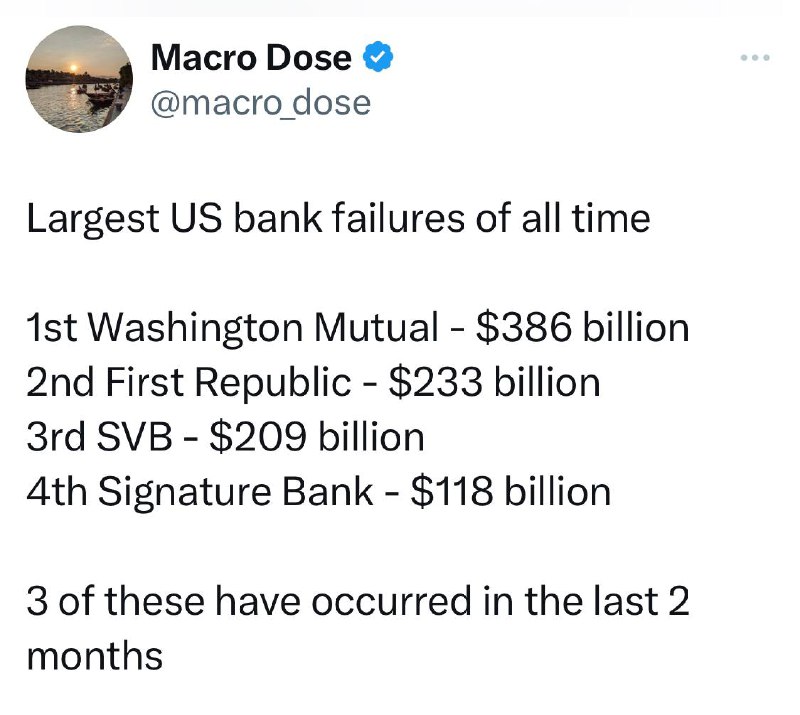

The FDIC seized and sold First Republic Bank, which is the third midsized bank failure in just two months and the second-largest bank failure (now) in US history. This doesn’t even include international bank crashes, such as Credit Suisse.

I am so shocked that this keeps happening. Who could have ever seen this coming?

Oh wait:

A Scheme By Those ‘Too Big To Fail’?

Two banks down. How many more to follow? And which banks?

Well, we can assume it will not likely be JP Morgan Chase.

They have seemed to position themselves into very fortuitous circumstances. Perhaps too conveniently

I would not be surprised at all if some of the Big Five were involved in this in some capacity. If not directly, then at least cheerleading it indirectly.

The smaller, regional banks are taking major hits, while the larger ones—the ones the Feds previously determined are “too big to fail”—are capturing most of those fleeing deposits.

Those Big Five have been fighting to secure a higher percentage of total assets for decades now.

[…]

Centralization, at its finest.

Welcome to 2023, the year when all the regional banks are going to die.

It is fascinating to me that more people are not concerned about this. We are facing massive inflation, de-dollarization, major bankruptcies/layoffs, and then the cherry on top with major U.S. bank collapses. These are not small banks crashing. This trend is unheard of in American history. At least with SVB people at least pretended to care for a couple of days. No one even seems to notice anymore. Stocks are up.

Is everyone blind?

Hardly no one is preparing. The water is accumulating, yet no one is building an ark. But this is a silver lining for us. It gives you time to prepare while everyone else is walking around oblivious. Major changes are coming, and if you cannot see that by now, I do not know what else to tell you.

If you want to know the next regional banks likely to fall, start with the iShares U.S. Regional Banks ETF. Look at its holdings for a list of regional banks. Then check those regional banks themselves over the past year (stock price change). Find the worst hit institutions and then check to see if they are holding similar problematic assets as SVB/Signature/FRB on their balance sheet. Rank them accordingly.

Alternatively, you can also use the largest banks in U.S. list from Wikipedia instead of the ETF. But then follow the same logical pathway.

If you would have done this post-SVB, you would have quickly pegged First Republic as an option for the next domino.

My top picks for next likely bank failures:

In no particular order.

I suppose we shall see how it plays out. But one thing is for certain: the grey masses won’t see any of it coming, no matter how many warning signals are given to them.

Read Next: The Crippled Reserve Status

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)

When a silver quarter has $5.70 in melt value, something might be breaking down. I have run into .223 bullets constructed from swedged, spent .22 rimfire long rifle cases filled with lead. Diesel engines pre 2006 have been know to run on 75% regular gasoline mixed with 25% 30wt. motor oil, in a pinch. The point is, this country may need more than a few alternate methods when or before the government moves forward toward reformation. The CFR has instilled a large degree of arrogance into elected figureheads. This serves to flush out dissidents, but furthermore indicates those who are totally bought in to the WEF’s new world order. Those behind the scenes should be the focus of all who desire a reset to the original US Constitution, and with three equal branches of government.

Certainly a fair point.