Most Recent News

Popular News

Further centralization by those in the 'too big to fail' club.

Two banks down. How many more to follow? And which banks?

Well, we can assume it will not likely be JP Morgan Chase.

They have seemed to position themselves into very fortuitous circumstances. Perhaps too conveniently:

Prominent venture capitalists advised their tech startups to withdraw money from Silicon Valley Bank, while mega institutions such as JP Morgan Chase & Co sought to convince some SVB customers to move their funds Thursday by touting the safety of their assets.

– Bloomberg & The InformationLet us get this straight: the largest US commercial bank was actively soliciting the clients of one of its biggest competitors, and the 16th largest US bank, knowing full well deposit flight would almost certainly lead to the collapse of a bank which courtesy of fractional reserve banking, had only modest cash to satisfy deposit demands: certainly not enough to meet $42 billion in deposit outflows.

Of course, Jamie, who has suddenly emerged as a key figure in the Jeff Epstein scandal alongside Jes Staley, knows this, and would be delighted with an outcome that kills two birds with one stone: take his name off the front pages and also make JPMorgan even bigger. Actually three birds: remember it was JPM that started that “Not QE” Fed liquidity injection in Sept 2019 when the bank “suddenly” found itself reserve constrained. We doubt that JPM would mind greatly if Powell ended his rate hikes and eased/launched QE as a result of a bank crisis, a bank crisis that Jamie helped precipitate.

And while we wait to see if Dimon’s participation in the Epstein scandal will now fade from media coverage, and whether Powell will launch QE, we know one thing for sure: JPM was a clear and immediate benefactor of SIVB’s collapse because in a day when everything crashed, JPM stock was one of the handful that were up.

– Zerohedge

I would not be surprised at all if some of the Big Five were involved in this in some capacity. If not directly, then at least cheerleading it indirectly.

The smaller, regional banks are taking major hits, while the larger ones—the ones the Feds previously determined are “too big to fail”—are capturing most of those fleeing deposits.

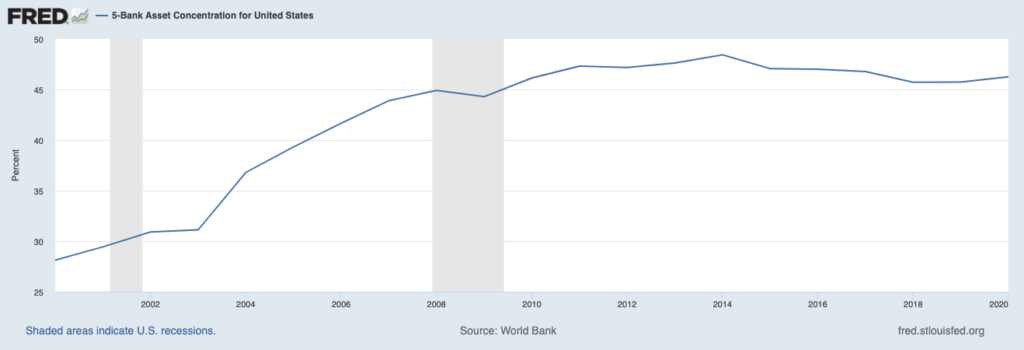

Those Big Five have been fighting to secure a higher percentage of total assets for decades now. Just look at the progression over time:

They were diving upwards for quite a while, especially preceding recorded data by the Fed. Now, they’ve largely plateaued. Perfect timing for another credit crisis or bank run crisis to help them shore up further percentages.

Centralization, at its finest.

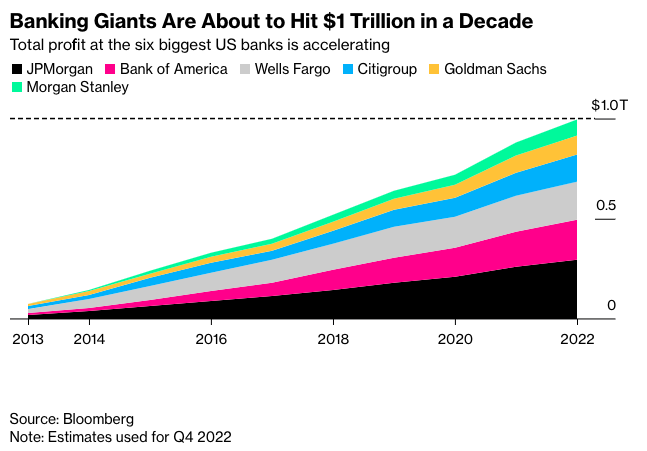

The “Big Five” is also somewhat misleading. It should more accurately be the “Big Six”. Review the largest banks by asset size:

Chase and Bank of America are centralization megaliths. But they aren’t alone. And frankly, Morgan Stanley should be included.

U.S. Bancorp is half the size of Morgan Stanley. But Stanley is not included in the Big Five. Even though it eclipses the old trillion standard.

But returning to the main point, these six institutions have much to gain if the smaller regional institutions start seeing fleeing deposits. In fact, #18 was SBV that recently crashed.

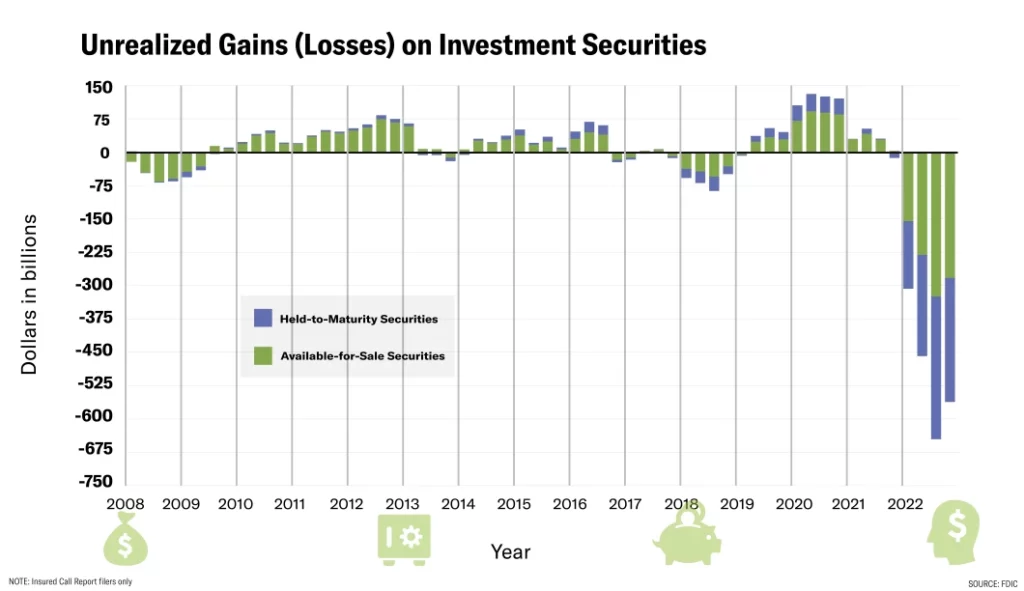

All the institutions outside of the Big 6 are at major risk of unrealized losses on securities. Something that the Big 6 largely hedged against, coincidentally:

All six of these main players have safeguards against what just happened to Signature and SVB. All six also benefit (at least) fourfold if this collapse trend continues. This is because it will force the following:

Yet, no one seems to be picking this story up. There are a lot of dots here that remain to be connected, but the overall picture is already forming.

Very odd coincidence, is all that I am saying.

Read Next: Our Irrational Markets

If you enjoyed this article, bookmark the website and check back often for new content. New articles most weekdays.

You can also keep up with my writing by joining my monthly newsletter.

Help fight the censorship – Share this article!

(Learn More About The Dominion Newsletter Here)

Alright, it finally seems to works again, this was my reason to stop commenting for so long by the way.

Anyway, if you remember me, you remember I align with anarchy/libertarianism right?

While observing the war against Russia and Ukraine (or Russia vs west-Russia kind of?), and having heard both sides out with an open heart, I got to understand what this conflict is actually about, and it made me reconsider my alignment.

The Ukraine vs Russia thing isn’t just a pre-planned psyop to make room for a 1 world government like how I previously saw it.

Rather, I came to the conclusion that it’s a fight between unipolarism (Ukraine and the west) and multipolarism (Russia), or to put it in simpler terms, a fight between a highly political 1 world global government system vs the return to a world of many distinct civilizations with respect for each other’s soil and/or competition between each other, and where the nation state is there to serve the people, rather than the other way around.

I already expressed before that I prefer a multipolar world over a unipolar world, seeing how things are unfolding, it really seems like we’re headed back into that direction.

And this I think has been a massive wake up call for me.

Yes, true freedom is great, but realistically speaking I think going back to the concept of civilization states is probably a much healthier answer that benefits civilizations as a whole, and also fits more with human natural instincts of tribalism.

This idea in the modern age has started in Asia, and I do expect more Asian countries coming to this same conclusion, and maybe Latin America (or at least Mexico, Brazil, and Peru) as well.

I know this is off topic, but what do you think?

Have you had problems commenting? If so, send an email. You can always keep the email anonymous. Sometimes the website code runs into problems, and I don’t hear about it until way later, which always sucks. Miss out on a lot of great comments.

Anyway, happy to have you back. Here are my thoughts:

Dead on. The West wants to keep its hegemony in the world. Russia/China/Iran/etc are starting to be problem children, standing in the way of Daddy America.

Agreed. But the United States will not let it go naturally. Our rulers will fight it until the bitter end. This is why it’s almost a certainty that conflict is stirring, and our generations will be the ones that endure it.

Agreed fully. You followed a similar path to me. I was also on the anarchist bent for quite a while, but with more knowledge comes higher understanding of the reality we live in. Civilization states (or “national states” within a homogeneous civilization) are the only true way forward to escape clown world. Nothing else will get us there. It is either that or succumbing to a one world system, because the former naturally devolves into it. I’ve been writing about this quite a lot recently. Civilizations are healthy for each unique people around the world and these civilizations are based wholly on these unique people so they can answer the questions and problems that are peculiar to those specific people. And they require a multipolar world order, which is needed.

Also agreed. The Asian countries are recognizing the splintering of the West, due to our own stupidity in not protecting our civilizational founding. The Asians are smartly avoiding it, and planning for a future where these civilizations matter once again.

Thank you for your answers.

I thought I was looking for a way to contact you, but all I could find as social media profiles I was already kicked out of, although I don’t remember seeing a contact form, but I’ll use that next time this happens.

People always tend to respond to one extreme by pivoting towards the opposite extreme (like answering with anarchy to tyranny, or communism to corporatism, or religion to woke ideology), but as time goes on you’ll find that the solution is actually much more moderate.

Speaking of which, I’ve been looking into religions for a while, and every time I found myself back at the same spot, because even though on the surface Buddhism is very different from Islam, which is very different from Christianity, which is very different from Judiaism, and so on, at a deeper level they all strangely have a lot in common with one other, and the deeper I went, the more I came to the conclusion that they’re all the same after all.

As for Asians avoiding clown world, it’s not really that we’re avoiding, more like delaying.

Asians generally value stability, and with that avoid risks as much as possible.

Which is quite different from the west, who’s striving to be the first to implement the latest hottest thing.

Because of that it’s often really hard for non-Asians to really understand Asia.

This is why major cities are always modernizing because that’s where all the faraway foreigners go to on vacation, but generally the further away you go from these cities, the more of the true face of Asian countries you’ll see, and westerners I invited into the countryside even started calling Japan a “3rd world country”, just because the environment holds on to the past rather than erecting massive skyscrapers made out of glass like how it’s done in the major cities.

I’ll look for your writings on civilization states, would be interesting to read.

Anytime, brother.

It sounds like you are on track to traditionalism/perennialism. Rene Guenon and Frithjof Schuon are great reads in this category, if you have not heard of them:

I am a Christian, so I don’t buy into the perennial school of thought personally, but I do find an interest in reading their writings. It’s very insightful when doing comparative religious study. I have done a deep dive into most of the world’s major religions (Hinduism, Buddhism, Judaism, Taoism, Christianity, Islam, the cults, etc.) Including reading their major scriptures. I’ve found most are similar as the perrenialists state, but New Testament Christianity is an exception. If you have not, I’d read the New Testament before going too deep into perennialism. It’s the only work that truly contradicts the other major religions. If Christianity is right, the others are wrong. If the others are right, they all generally just lead to the same path anyway. It’s important to single out Christianity for this reason, which is what lead me to a much deeper understanding of God and faith.

Your insight on the Asian front is always fascinating. I have much to learn about that region. It definitely needs to be a target region for my future research, as I am lacking in that area.

Just watched a pretty inspiring video on how civilizations are based off one of 7 emotions: https://yewtu.be/watch?v=Ul2iW3mWl90

A lot of interesting knowledge, but based on my knowledge on east Asia and in a more limited degree the west, it really makes lots of sense, explains the many differences our 2 sides hold, and much more.

Will watch soon. Thanks for the share.

Homo sapiens are a species, but cultures are the magic that defeats barbarism, for within the species lies tribes of lesser respect for God.

It is true that culture is an imperative. Biology (the nation), morality, and culture must be combined for a healthy nation-state. One without the others will inevitably lead to failure.